Check Out Well-Known hard money lenders in Atlanta Georgia Right Away

Check Out Well-Known hard money lenders in Atlanta Georgia Right Away

Blog Article

The Impact of a Hard Money Financing on Property Funding Approaches

In the facility field of property funding, tough Money finances have become a potent tool, using investors a quick path to capital. Nevertheless, this financing technique, with its emphasis on property worth over debtor creditworthiness, includes its own collection of distinct challenges. High rates of interest and short payment periods are among the truths financiers need to navigate. Recognizing the ins and outs of difficult Money finances is important for financiers aiming to take full advantage of returns while mitigating threats.

Recognizing the Concept of Hard Money Loans

These car loans are identified by their high interest rates and shorter payment durations contrasted to conventional loans. Difficult Money car loans are frequently the go-to choice for genuine estate financiers that require fast funding or those with bad credit rating background. Understanding the details of tough Money finances is critical for any type of actual estate capitalist or developer as it can open up brand-new opportunities for residential or commercial property financial investment and development.

The Pros and Cons of Hard Money Loans in Property

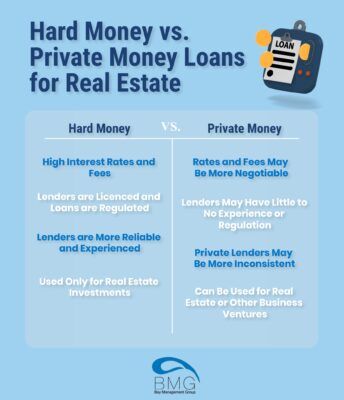

Difficult Money car loans in genuine estate featured their one-of-a-kind set of advantages and possible dangers (hard money lenders in atlanta georgia). A close examination of these elements is important for capitalists thinking about this type of financing. The following discussion will intend to clarify the pros and disadvantages, supplying a thorough understanding of hard Money finances

Evaluating Hard Money Advantages

In spite of the possible difficulties, hard Money financings can use considerable benefits for actual estate financiers. Furthermore, difficult Money lendings supply adaptability. Custom-made Loan terms can be negotiated based on the financier's unique requirements and job specifics.

Understanding Possible Finance Risks

While difficult Money loans use enticing advantages, it is necessary to understand the inherent threats involved. The high interest prices and brief settlement periods can put borrowers in a precarious economic circumstance if they stop working to produce a quick return on financial investment. Additionally, the building, which offers as the Loan collateral, is at stake if payment stops working. Hard Money lenders, unlike standard financial institutions, are not always subject to the same laws and oversight. This absence of regulation can possibly subject debtors to deceitful lending techniques. The approval of a Hard Money Lending is mostly based on the property value, not the customer's creditworthiness, which can motivate risky financial behavior.

Contrasting Tough Money Fundings With Conventional Funding Choices

How do hard Money fundings contrast with typical financing options in the real estate market? Difficult Money lendings, typically sought by capitalists for quick, short-term funding, are defined by their fast authorization and financing process. Tough Money lendings usually have a much shorter term, typically around 12 months, while standard finances can extend to 15 to 30 years.

Instance Studies: Effective Property Deals Funded by Hard Money Loans

In an additional situation, a real estate investor in Miami was able to close a deal on a multi-unit domestic building within days, thanks to the fast approval procedure of a Hard Money Funding. These situations underline the role difficult Money financings can play in promoting lucrative genuine estate bargains, attesting to their critical value in actual estate funding.

How to Protect a Hard Money Loan: A Step-by-Step Overview

Safeguarding a Hard Money Lending, simply like the Austin designer and Miami capitalist did, can be a considerable game-changer in the real estate sector. After selecting a lender, the debtor must offer a compelling instance, usually by demonstrating the possible profitability of the home and their capability to settle the Financing. When the lender approves the proposal and reviews, the Funding arrangement useful source is drawn up, authorized, and funds are paid out.

Tips for Making Best Use Of the Advantages of Hard Money Loans in Property Investment

To exploit the full possibility of hard Money finances in realty investment, smart financiers use a range of strategies. One such method entails making use of the quick authorization and financing times of tough Money loans to maximize financially rewarding deals that require quick action. One more method is to use these financings for residential property improvements, thereby increasing the value of the home and potentially achieving a higher sale price. Investors should also be conscious of the Loan's conditions and terms, guaranteeing they appropriate for their investment strategies. It's prudent to build healthy and balanced relationships with difficult Money lending institutions, as this can lead to extra favorable Funding terms and possible future funding possibilities. These methods can make best use of the advantages of tough Money fundings in the actual estate market.

Verdict

In verdict, tough article Money financings can be a powerful device in a real estate financier's funding arsenal, supplying fast access to funding and facilitating revenue generation from renovation or purchase jobs. Their high-cost nature requires detailed due diligence and why not try this out tactical preparation. Capitalists should make sure that possible returns justify the involved dangers which they have the ability to take care of the short repayment timelines efficiently.

These financings are characterized by their high interest rates and shorter payment durations contrasted to conventional financings. Hard Money fundings are usually the go-to choice for real estate financiers that require quick funding or those with bad credit report background (hard money lenders in atlanta georgia). Recognizing the intricacies of tough Money loans is essential for any type of genuine estate capitalist or programmer as it can open up brand-new opportunities for residential or commercial property investment and development

Tough Money loans normally have a much shorter term, typically around 12 months, while conventional lendings can extend to 15 to 30 years. These scenarios underscore the duty difficult Money lendings can play in helping with profitable genuine estate deals, proving to their calculated value in genuine estate financing.

Report this page